If you’re into betting, you’ve probably heard of the Kelly Criterion. It’s a formula that can help you determine the optimal amount of money to bet on any given outcome. The Kelly Criterion has been around for quite some time and is widely regarded as one of the best ways to maximize your returns while minimizing your risks. In this guide, we will take a deep dive into what the Kelly Criterion is, how it works, and how you can use it to improve your betting strategy.

What is the Kelly Criterion?

The Kelly Criterion is a formula that calculates the optimal amount of money to bet on any given outcome based on the probability of that outcome occurring and the payoff of that outcome. It was first developed by John Kelly, a scientist at Bell Labs, in the 1950s. The Kelly Criterion is often used in investing and has since been adapted to betting.

The formula for the Kelly Criterion is as follows:

f* = (bp – q) / b

Where:

f* is the fraction of your bankroll you should bet

b is the decimal odds-1 (if the odds are 2.0, then b = 1)

p is the probability of winning

q is the probability of losing (1 – p)

How Does the Kelly Criterion Work?

The Kelly Criterion works by determining the optimal amount of money to bet on any given outcome. It takes into account the probability of that outcome occurring and the payoff of that outcome. By using the Kelly Criterion, you can determine the exact amount of money to bet that will maximize your returns while minimizing your risks.

To illustrate how the Kelly Criterion works, let’s say you are betting on a coin flip. The odds of the coin landing on heads are 50%, and the odds of the coin landing on tails are also 50%. The payoff for winning the bet is even money (1:1). Using the Kelly Criterion formula, we can calculate the optimal amount of money to bet as follows:

f* = (0.5 x 1 – 0.5) / 1

f* = 0.0

This means that the optimal amount of money to bet on this outcome is zero. According to the Kelly Criterion, you should not bet anything on this outcome since the expected value of the bet is zero.

However, let’s say the odds of the coin landing on heads were 60%, and the payoff for winning the bet was still even money. Using the Kelly Criterion formula, we can calculate the optimal amount of money to bet as follows:

f* = (0.6 x 1 – 0.4) / 1

f* = 0.2

This means that the optimal amount of money to bet on this outcome is 20% of your bankroll. According to the Kelly Criterion, betting 20% of your bankroll on this outcome will maximize your returns while minimizing your risks.

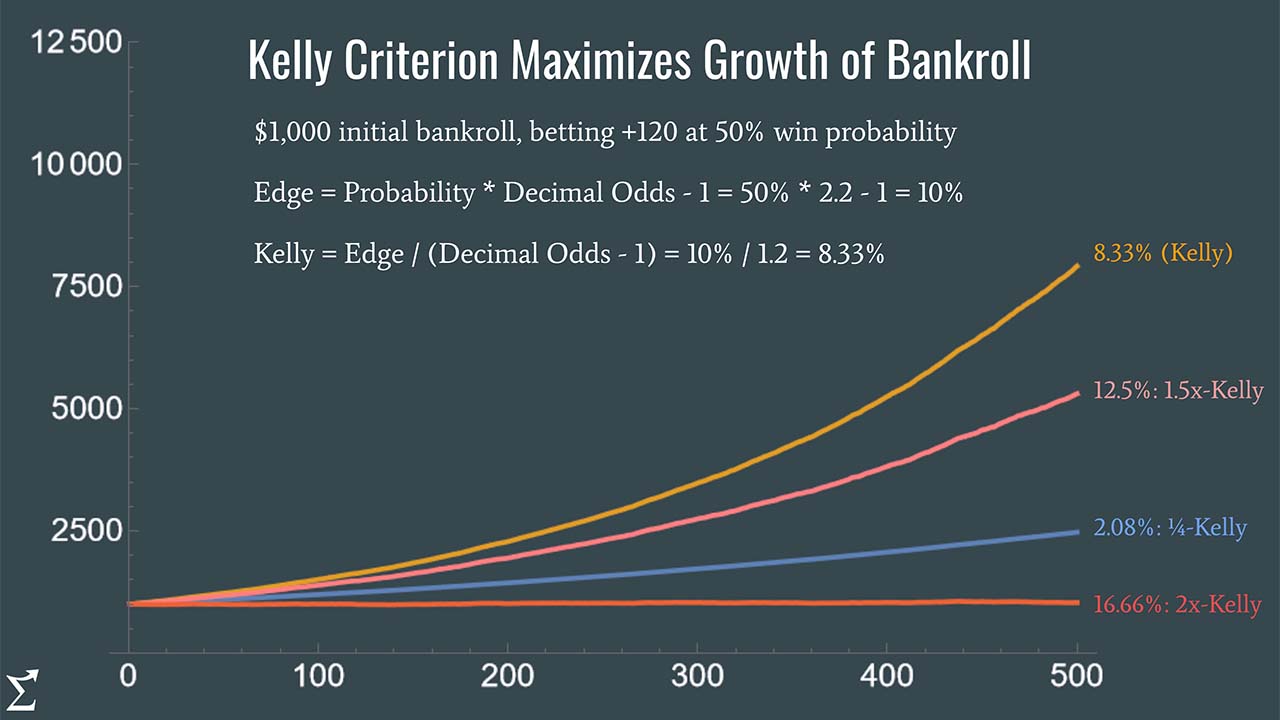

Different Types of Kelly Criterion Strategies

There are different types of Kelly Criterion strategies that you can use depending on your risk tolerance and goals. Here are a few examples:

Full Kelly: This strategy recommends betting your entire bankroll when the Kelly Criterion indicates that the bet has a positive expected value.

Half Kelly: This strategy recommends betting half of your bankroll when the Kelly Criterion indicates that the bet has a positive expected value.

Quarter Kelly: This strategy recommends betting a quarter of your bankroll when the Kelly Criterion indicates that the bet has a positive expected value.

Fixed Fractional: This strategy recommends betting a fixed fraction of your bankroll, such as 1% or 2%, on each bet regardless of the Kelly Criterion’s recommendations.

Pros and Cons of Kelly Criterion Strategies

There are pros and cons to using Kelly Criterion strategies. Here are some of the main ones to consider:

Pros:

- Maximizes returns: Using the Kelly Criterion can help you maximize your returns by betting the optimal amount on each outcome.

- Minimizes risks: By betting the optimal amount, you can minimize your risks and avoid losing large amounts of money.

- Simple to use: The formula for the Kelly Criterion is straightforward and easy to use, even for beginners.

- Adaptable: There are different types of Kelly Criterion strategies that you can use depending on your risk tolerance and goals.

Cons:

- Requires accurate probabilities: The Kelly Criterion is only as accurate as the probabilities you use. If your probabilities are incorrect, the Kelly Criterion will not work as well.

- Can be difficult to calculate: While the formula for the Kelly Criterion is straightforward, calculating the decimal odds and probabilities can be challenging for some.

- No guarantee of success: Even if you use the Kelly Criterion, there is no guarantee that you will win your bets. It is just a tool to help you make more informed decisions.

Examples of Kelly Criterion in Action

To better understand how the Kelly Criterion works in practice, let’s look at some examples.

Example 1: Betting on a Football Game

Let’s say you are betting on a football game between Team A and Team B. The odds for Team A to win are 2.5, and the odds for Team B to win are 1.5. You have calculated that Team A has a 60% chance of winning and a 40% chance of losing.

Using the Kelly Criterion formula, we can calculate the optimal amount of money to bet on Team A as follows:

f* = (0.6 x 2.5 – 0.4) / 1.5

f* = 0.4

This means that the optimal amount of money to bet on Team A is 40% of your bankroll. According to the Kelly Criterion, betting 40% of your bankroll on Team A will maximize your returns while minimizing your risks.

Example 2: Betting on a Horse Race

Let’s say you are betting on a horse race, and the odds for Horse A to win are 3.0, and the odds for Horse B to win are 1.5. You have calculated that Horse A has a 30% chance of winning and a 70% chance of losing.

Using the Kelly Criterion formula, we can calculate the optimal amount of money to bet on Horse A as follows:

f* = (0.3 x 3 – 0.7) / 2

f* = -0.1

This means that the Kelly Criterion is indicating that you should not bet on Horse A. In this scenario, the expected value of the bet is negative, which means that it is not worth taking the risk.

Casino Games That Can Be Best Used With Kelly Criterion

The Kelly Criterion can be used in a variety of casino games. Here are a few examples:

- Blackjack: The Kelly Criterion can be used in blackjack by calculating the probability of winning each hand and the payoff for each hand.

- Roulette: The Kelly Criterion can be used in roulette by calculating the probability of winning each bet and the payoff for each bet.

- Craps: The Kelly Criterion can be used in craps by calculating the probability of winning each bet and the payoff for each bet.

Conclusion

The Kelly Criterion is a powerful tool that can help you maximize your returns while minimizing your risks in gambling and betting. By using the Kelly Criterion formula to calculate the optimal amount of money to bet on each outcome, you can make more informed decisions and increase your chances of winning. However, it’s important to keep in mind that the Kelly Criterion is not a guaranteed way to win at betting, and accurate probabilities are crucial to its effectiveness.

There are also different types of Kelly Criterion strategies that you can use depending on your risk tolerance and goals. And while it can be challenging to calculate decimal odds and probabilities, the formula for the Kelly Criterion itself is straightforward and adaptable.

Overall, the Kelly Criterion is a valuable tool for any gambler or bettor looking to improve their win rate and make more informed decisions. By incorporating it into your betting strategy and using it alongside other techniques, you can maximize your returns and minimize your risks in any type of gambling.

Frequently Asked Questions

Q: Is the Kelly Criterion a guaranteed way to win at betting?

A: No, the Kelly Criterion is not a guaranteed way to win at betting. It is just a tool to help you make more informed decisions.

Q: Can the Kelly Criterion be used in sports betting?

A: Yes, the Kelly Criterion can be used in sports betting by calculating the probability of winning each bet and the payoff for each bet.

Q: Can the Kelly Criterion be used for any type of gambling?

A: Yes, the Kelly Criterion can be used for any type of gambling that involves a positive expected value.

Q: How do I calculate the decimal odds and probabilities?

A: Decimal odds can be calculated by dividing the total payout (including the initial stake) by the stake amount. Probabilities can be calculated by dividing 1 by the decimal odds.

Q: Can the Kelly Criterion be used in conjunction with other betting strategies?

A: Yes, the Kelly Criterion can be used in conjunction with other betting strategies to help you make more informed decisions.